Our services

For every service we provide, we promise you will receive the best treatment in the industry. If your desired area of expertise is not listed below, please contact us.

Payroll

Managing payroll can be time-consuming and complex, but at Taxstacks, we make the process seamless. We ensure that payroll is processed accurately and that all payments are prepared on time, so your employees receive their salaries without delay. Our expertise keeps your business fully compliant with tax regulations, eliminating the stress of changing laws and administrative burdens. With our personalized approach, you have a reliable partner who understands your business needs.

Payroll Services – Accurate, Compliant and Worry-Free

ContactManaging payroll is essential, but it can quickly become a burden. At Taxstacks, we offer end-to-end payroll solutions that take the complexity out of your hands. So you can focus on running your business.

Why Choose Taxstacks for Payroll?

- Always on time: We ensure every employee is paid accurately and on schedule.

- Fully compliant: We handle all payroll-related taxes, filings, and reports in line with the latest legislation.

- Tailored to your needs: Whether you're a small business or a growing enterprise, we scale our services to match your operations.

- Secure and confidential: Your employee and company data is managed with the highest level of security and discretion.

- Real support: A dedicated payroll expert is always available to answer your questions and adjust to changes quickly.

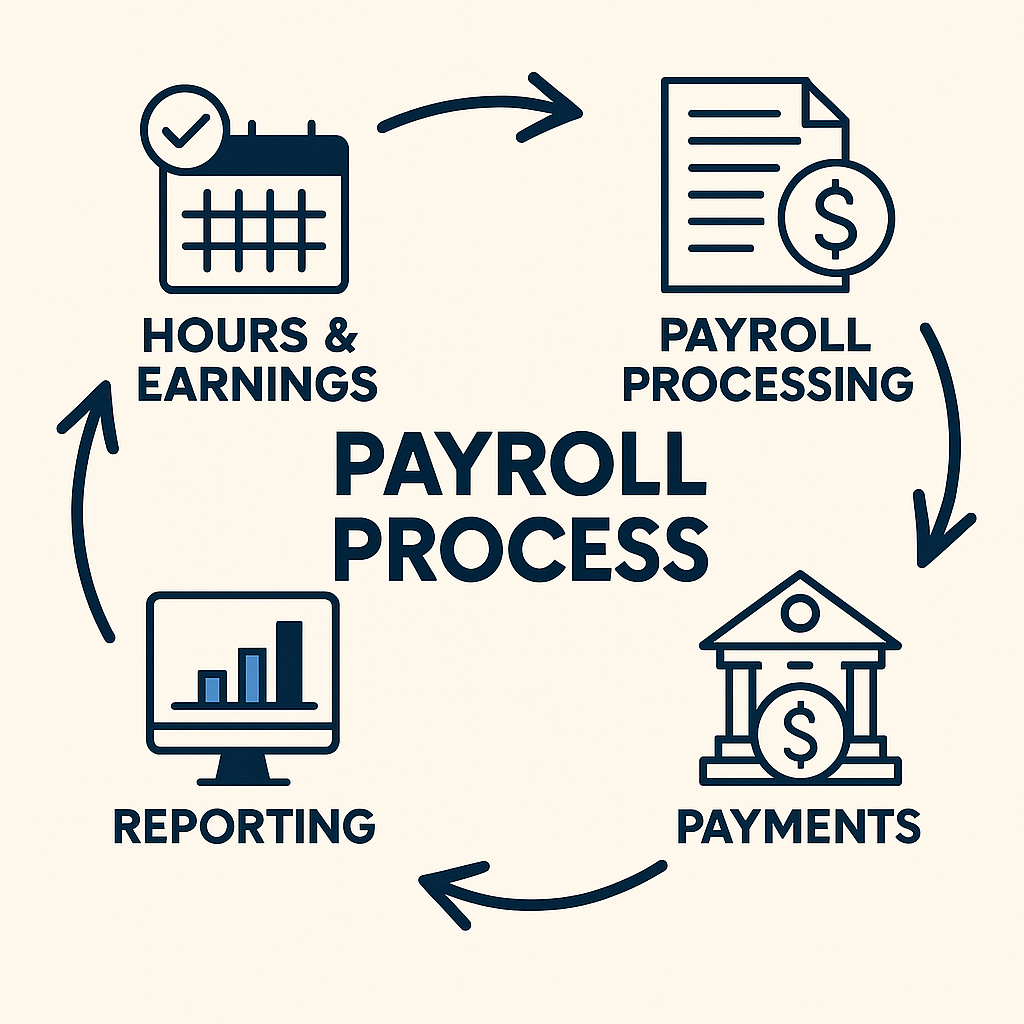

Our Payroll Process

- Data Collection: We gather necessary employee data: hours worked, leave, bonuses, tax codes, and benefits.

- Payroll Calculation: We process gross pay, deductions, employer costs, and generate payslips with precision.

- Salary Distribution: Payments are securely transferred to employees’ bank accounts on the agreed-upon schedule.

- Tax & Reporting: We handle all payroll taxes, social contributions, and submit required filings to tax authorities.

- Ongoing Support: We provide monthly reports, year-end summaries, and proactive advice to keep you ahead of changes.

Ready to Streamline Your Payroll?

Let us handle your payroll so you can focus on what matters most. Growing your business.

Tax advice

We provide practical and strategic tax advice to employers in the private sector. Our services are designed to help organizations navigate complex tax matters and make well-informed decisions that comply with current legislation.

With deep expertise in income tax, VAT (sales tax), and corporate tax law, we support our clients in areas such as tax planning, compliance, risk management, and the interpretation of tax legislation. We combine technical knowledge with a clear understanding of business dynamics, ensuring our advice is not only legally sound but also commercially relevant.

Whether it concerns day-to-day operational questions or long-term strategic tax planning, our team is committed to delivering clear, reliable, and actionable guidance.

Our Key Tax Advisory Services

1. Corporate Tax Advisory

We help businesses manage their corporate tax obligations effectively by providing guidance on tax-efficient structuring, deductions, and compliance with local and international tax regulations. Our services include assistance with corporate income tax returns, advance tax rulings, and tax risk assessments.

2. VAT / Sales Tax Advisory

We offer comprehensive support in managing VAT obligations, including registration, filings, cross-border transactions, and sector-specific VAT issues. We help minimize VAT risks and optimize recovery strategies, ensuring full compliance with evolving legislation.

3. Personal Income Tax Support

For directors, entrepreneurs, and employees with complex income structures, we provide tailored income tax advice. This includes optimizing salary structures, managing benefits-in-kind, and supporting expatriates or cross-border workers with residency and double taxation issues.

4. Tax Planning & Structuring

Our forward-looking tax planning strategies help clients legally minimize tax burdens through effective corporate structures, investment planning, mergers & acquisitions, and succession planning. We ensure all structures align with commercial goals and tax laws.

5. Tax Compliance & Reporting

We assist with accurate and timely tax filings, ensuring businesses meet all compliance requirements. This includes the preparation and review of tax returns, supporting documentation, and responding to inquiries from tax authorities.

6. HR & Payroll Tax Advice

Our team advises on employment-related tax matters such as fringe benefits, pensions, expense allowances, and payroll taxes. We work closely with HR departments to ensure optimal, compliant remuneration strategies.

Tax return

Expert guidance for individuals and businesses navigating the Dutch tax system

The Dutch tax system is known for its complexity. With constantly changing rules and detailed compliance requirements, staying on top of your obligations can be challenging. At

Taxstacks, we specialize in tax legislation and offer tailored solutions that ensure your tax affairs are handled accurately, efficiently, and always in compliance with Dutch law.

Personal Income Tax (Inkomstenbelasting)

Filing your personal income tax return can be more complicated than expected. Many individuals unknowingly miss out on deductions or forget to declare income. This can lead to unnecessary tax payments or penalties.

We support individuals in a wide range of situations:

- Employees with deductible expenses

- Homeowners with mortgage interest deductions

- Freelancers and self-employed professionals

- Expats and cross-border workers

- Individuals with foreign income or assets

Our experts thoroughly review your financial situation, ensure all relevant deductions are claimed, and guarantee your tax return is fully compliant. We help you avoid mistakes, optimize your tax position, and provide peace of mind year after year.

Corporate Tax Services

Running a business demands your full attention. Tax compliance shouldn’t be a distraction. That’s why Taxstacks offers comprehensive tax support for self-employed professionals, small and medium-sized enterprises (SMEs), and incorporated businesses. We manage all ongoing tax obligations while offering strategic advice to optimize your tax position.

Our services include:

- VAT (BTW) returns: timely and accurate filings, including special VAT schemes

- ICP declarations: for EU intra-community transactions

- Corporate income tax (Vennootschapsbelasting): annual reporting and proactive planning

- Personal income tax for business owners: tailored for sole proprietors (zzp) and partnerships (vof)

- Dividend tax declarations: for director-shareholders and relevant structures

- M-form and cross-border filings: for individuals or businesses relocating in or out of the Netherlands

We keep a close eye on deadlines, communicate directly with the Dutch Tax Authorities on your behalf, and provide clear reporting so you always understand your fiscal position.

Are you interested in our services? We will help you!

We want to know exactly what you need, so that we can offer you the optimal solution. Let us know what you want and we will do our very best to serve you.